2024: A Tumultuous Year for Ottawa’s Real Estate Market

The year 2024 proved to be a dynamic and unpredictable period for Ottawa’s real estate market.

At the start of the year, we projected a bank rate decrease of 0.5–1.5% and anticipated home prices to rise by approximately 4%. However, as 2024 draws to a close, the bank rate as of December 11th stands at 3.25%, marking a 1.75% drop. This decrease was slightly larger than expected but nonetheless welcome and encouraging.

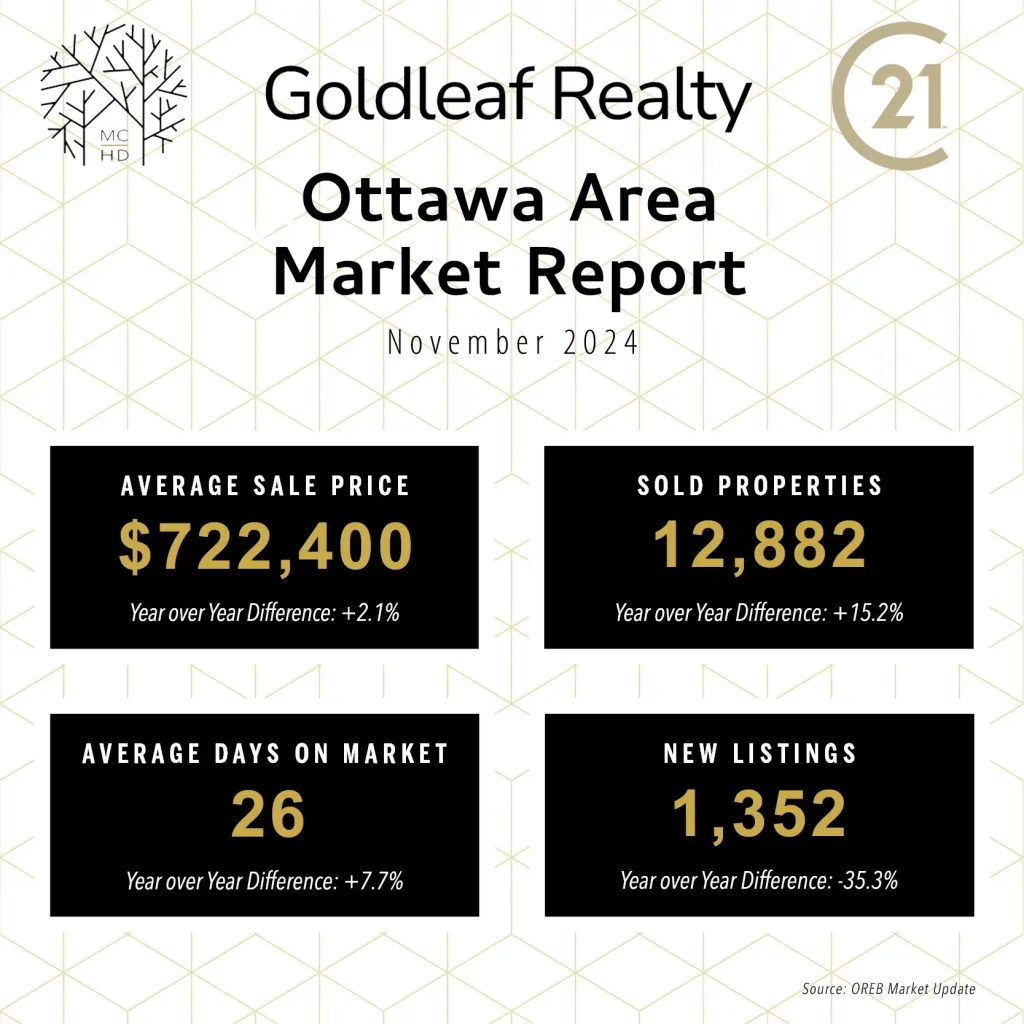

At the beginning of 2024, the average selling price for a single-family home in Ottawa was $636,700. By November, this figure had risen to $722,400, representing a 2.1% increase. While this fell short of the predicted 4% rise, the delay in market activity caused by cautious buyers led to a slower-than-expected start.

Buyer and Seller Dynamics

Buyers spent much of the year waiting for more significant interest rate cuts and lower house prices. Initial small rate decreases did little to improve affordability for first-time buyers, leaving many unable to qualify for a home in Ottawa. Simultaneously, sellers were hesitant to list their properties due to what they perceived as insufficiently attractive selling prices.

As a result, sales were slow during the first half of the year. However, activity began to pick up as the Bank of Canada implemented larger rate cuts, eventually spurring buyer interest. By early fall, more buyers entered the market, but this surge was met with limited inventory.

Supply Challenges and Market Acceleration

The influx of buyers confronted a significant lack of supply, particularly in desirable neighborhoods. Rising prices and shrinking inventory motivated buyers to act quickly, further depleting available listings. “For Sale” signs were rapidly replaced with “Sold” signs, and the average number of days on the market dropped to just 28 by November.

As supply dwindled, competition intensified, leading to multiple-offer situations in many areas. Although conditional offers were still possible in some cases, the market began to see an increase in unconditional, over-asking price bids as the year progressed.

Looking Ahead to 2025

As we move into 2025, we anticipate continued rate cuts, which will likely result in a highly active market characterized by low supply, high demand, and quick sales. These factors are expected to drive prices upward and further reduce the average days on the market.

Currently, there are fewer than 500 single-family homes under $900,000 listed on the Ottawa MLS—less than a month’s supply. With an early start to the spring market anticipated—likely in late January or early February—both sellers and buyers are advised to act quickly. Sellers should consider listing their homes as soon as possible, while buyers are encouraged to begin their search immediately.

While we await December’s final average sale price, we expect it to approach the projected 4% annual increase.

Returning to Market Stability

With a steady pace of home sales and more buyers reentering the market across all property classes, Ottawa’s real estate market is on track to reestablish its reputation for stability. We foresee steady, inflationary growth in home prices of 3–4%, supported by a healthy balance of available homes and motivated buyers, all underpinned by Ottawa’s stable local economy.

Ottawa Area Market Reports for November 2024